Irs Form 2024 Schedule 3 2024 – The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from $1,800 to $1,900 to $2,000 each . The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2024 tax season is the elimination of the Form 1040EZ. Taxpayers who previously .

Irs Form 2024 Schedule 3 2024

Source : www.kxan.comMost commonly requested tax forms | Tuition | ASU

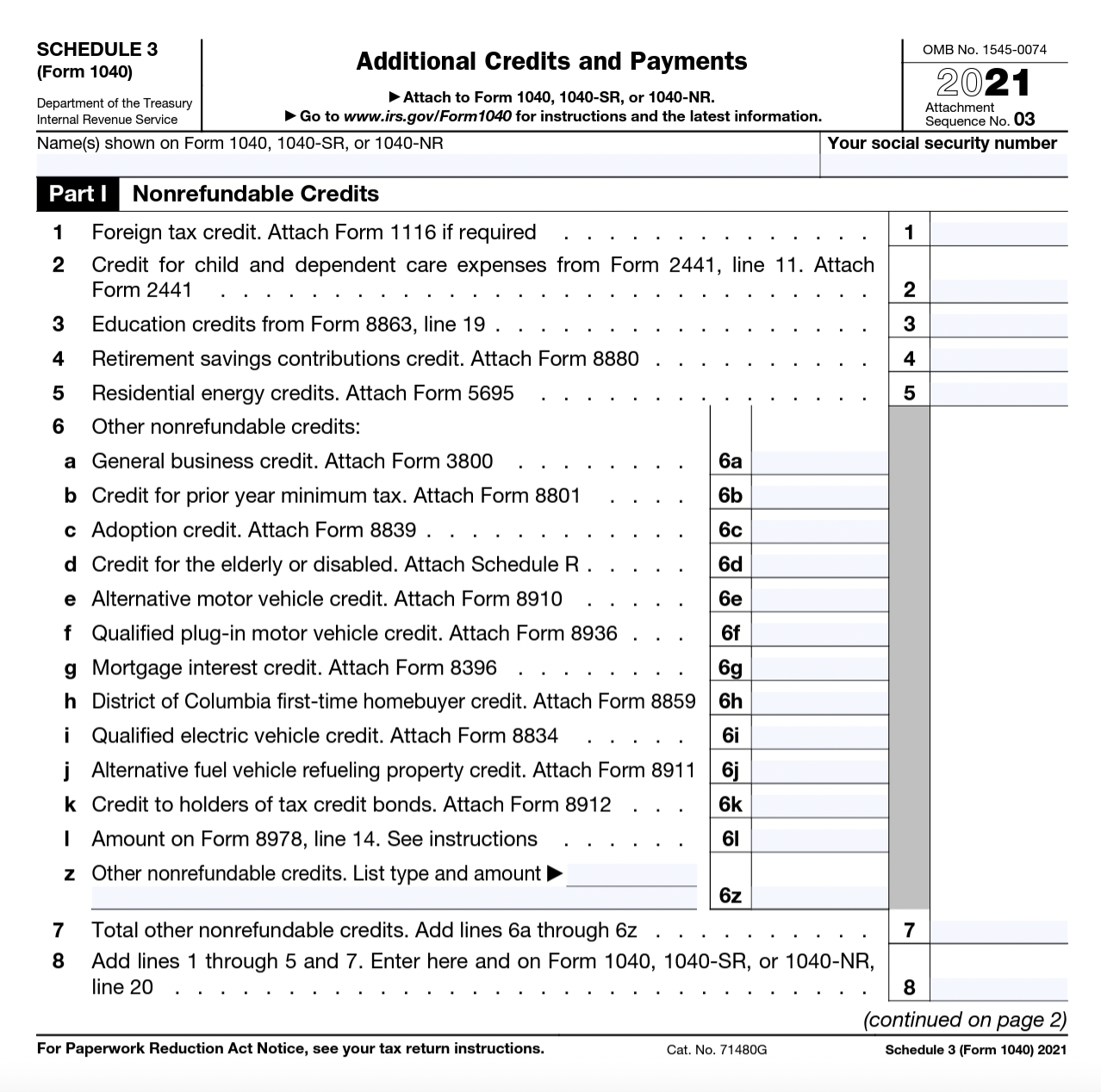

Source : tuition.asu.eduIRS Releases Schedule 3 Tax Form and Instructions for 2023 and

Source : www.kxan.comInstructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024)

Source : www.irs.govTax Season 2024: When does tax season starts for 2024? | Marca

Source : www.marca.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.com2023 2024 Verification Worksheet Independent by Hofstra

Source : issuu.com2024 Free Tax Help and Resources | Santa Clara Public Library

Source : www.sclibrary.orgInstructions for Schedule M 3 (Form 1120 L) (Rev. January 2024)

Source : www.irs.govIrs Form 2024 Schedule 3 2024 IRS Releases Schedule 3 Tax Form and Instructions for 2023 and : According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. . About three-quarters of taxpayers get a refund each year. That money is often highly anticipated, serving as a much-needed bump in cash flow at tax time. Find Out: Trump-Era Tax Cuts Are Expiring .

]]>